What is a HECS-HELP debt?

It’s a higher education loan payment that works a bit like a loan, but instead of the funds coming from a bank, the government makes a payment to your university on your behalf, saving you from potentially big upfront costs.

These loans don’t incur interest, and they don’t have an end date. Once you start working and earn over the income threshold of $67,000*, payments will commence via your employer’s payroll.

The amount payable is based on a certain percentage of your income; the higher you earn, the higher the repayment rate. For more information on this click here.

*FY2025-26 figure – thresholds change annually

Good news: You can still salary package and have a HECS-HELP debt.

If you’re seeking a better way to pay off your HECS-HELP debt, salary packaging can help. With a RemServ salary packaging account, you could put more money in your pocket each year and pay off your HECS-HELP sooner – win-win!

How it works

To make the most of your salary packaging and avoid being stung at tax time, all you need to do is ask your payroll department to deduct additional HECS-HELP repayments.

RemServ can help you work out how much with our HECS-HELP calculator.

Follow the steps in our online calculator here.

Health

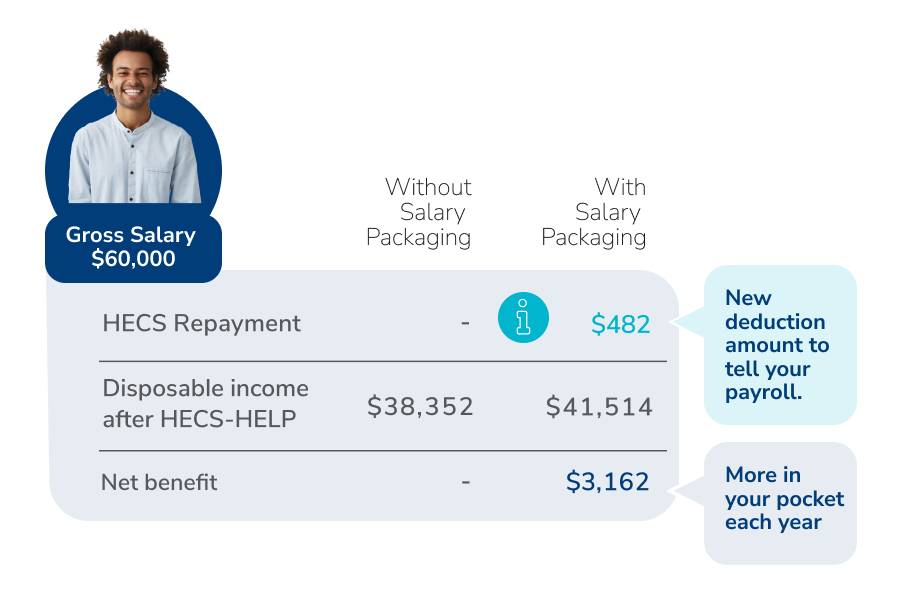

Let’s say you’re a health worker with a HECS-HELP debt earning $60,000. By packaging your full living expenses benefit of $9,010, as well as Meal Entertainment benefit of $2,650, you could be almost $3,162 better off each year!*

While your HECS-HELP repayments increase as they are calculated on this adjusted income, you could still increase your disposable income each year through reduced tax.

*Estimate Only: Individual circumstances may vary

Charity

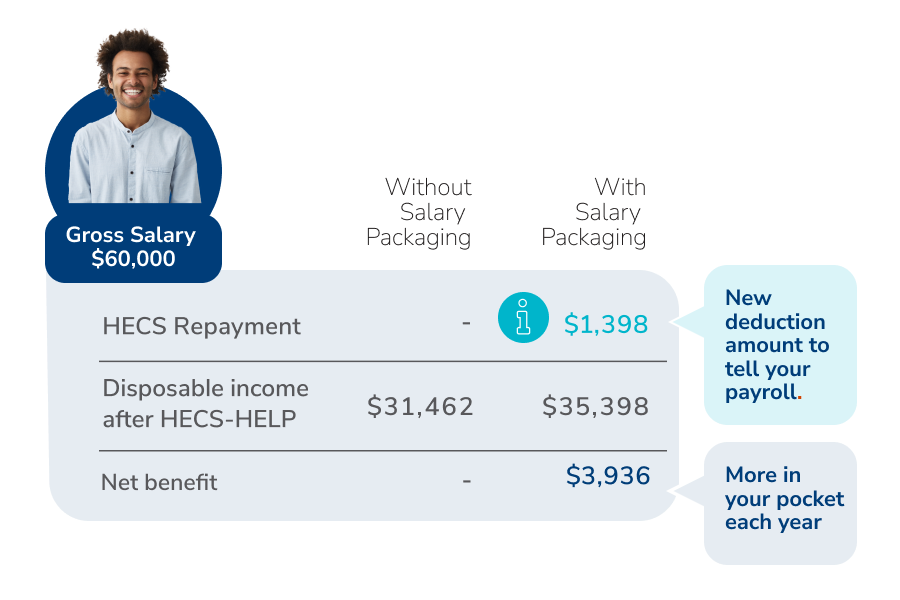

Let's say you work for a not-for-profit organisation earning $60,000. By packaging your full living expenses benefit of $15,900, as well as Meal Entertainment benefit of $2,650, you could be almost $3,936 better off each year!^

While your HECS-HELP repayments increase as they are calculated on this adjusted income, you could still increase your disposable income each year through reduced tax.

^Estimate Only: Individual circumstances may vary

Health

*Salary Packaging: The estimated potential tax benefit is based on an eligible employee with an annual salary of $60,000, salary packaging the full $9,010 per annum limit and claiming $2,650 in venue hire and meal entertainment expenses. PAYG tax rates effective 1 July 2024 have been used. HELP repayments are based on 2025-2026 HELP repayment thresholds and rates. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Estimated annual benefit based on the assumption that an employee does not have any accumulated Financial Supplement debt. Your disposable income will vary based on your income and personal circumstances. Compulsory HELP repayments commence once your adjusted taxable income is above $67,000.

Charity

^Salary Packaging: The estimated potential tax benefit is based on an eligible employee with an annual salary of $60,000, salary packaging the full $15,900 per annum limit and claiming $2,650 in venue hire and meal entertainment expenses. PAYG tax rates effective 1 July 2024 have been used. HELP repayments are based on 2025-2026 HELP repayment thresholds and rates. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Estimated annual benefit based on the assumption that an employee does not have any accumulated Financial Supplement debt. Your disposable income will vary based on your income and personal circumstances. Compulsory HELP repayments commence once your adjusted taxable income is above $67,000.

The Meal Entertainment benefit has a maximum annual cap limit of $2,650. This will appear as a reportable fringe benefit on your Payment Summary each year which will be included in a number of income tests relating to certain government benefits and obligations. This cap is separate from the FBT cap limits for everyday living expenses. The Meal Entertainment benefit does not cover take-away meals, groceries or eating out on your own.

Things you need to know: This general information doesn't take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. RemServ may receive commissions in connection with its services.

Remuneration Services (Qld) Pty Ltd | ABN 46 093 173 089 (RemServ)