Love to have access to more pay in your pocket each year? Without having to work for it? Great. Put your feet up and let’s talk salary packaging because it could be an easy way of taking home hundreds, if not thousands more in tax savings each year.

At RemServ, our passion for over 30 years has been helping Queenslanders like you, make the most of your income by making salary packaging simple and accessible.

With our help, you could pay less tax and enjoy more freed up money from your income. Depending on your employer and industry, you could be eligible for a wide range of salary packaging benefits.

It's all about getting your salary working harder, so you could be better off with potential tax savings.

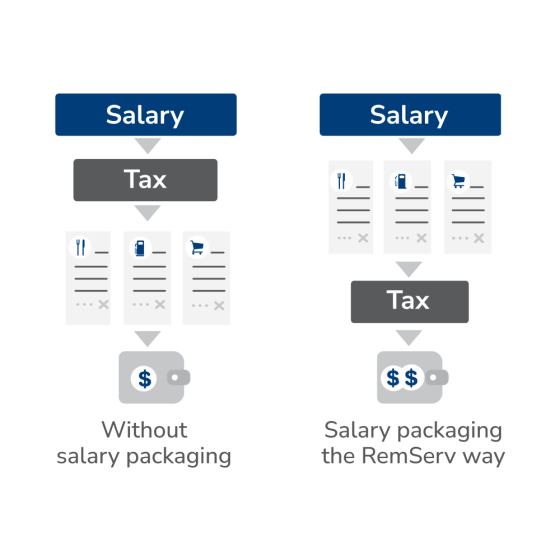

How does salary packaging work?

Salary packaging – or salary sacrificing as it's often known – is a workplace benefit where your employer allows you to access some of your pre-tax salary to spend on a wide range of benefits available for Queensland employees, whether you're in Brisbane, Gold Coast, Sunshine Coast, or other region across QLD. In turn, you could reduce your taxable income and boost your disposable income.

How much could you save in tax?

Salary packaging could be a hassle-free way to reduce your income tax and access more of your money. How much money? Well, to give you a better idea, the following table is for a person who earns $60k a year. We’ve included three sectors to show how the benefits vary.

If you work for a public or not-profit private hospital in QLD, you could be eligible to package up to $9,010 towards Living Expenses, and on top of that, up to $2,650 towards Meal Entertainment. You could also package a novated lease and uncapped benefits that don’t attract Fringe Benefits Tax.

*Estimate Only: Not financial advice. Tax outcomes will vary based on individual circumstances.

If you work for a charity, non-profit, PBI, aged care or disability services organisation in QLD, you could be eligible to package up to $15,900 towards Living Expenses, and on top of that, up to $2,650 towards Meal Entertainment. You could also package a novated lease and uncapped benefits that don’t attract Fringe Benefits Tax.

^Estimate Only: Not financial advice. Tax outcomes will vary based on individual circumstances.

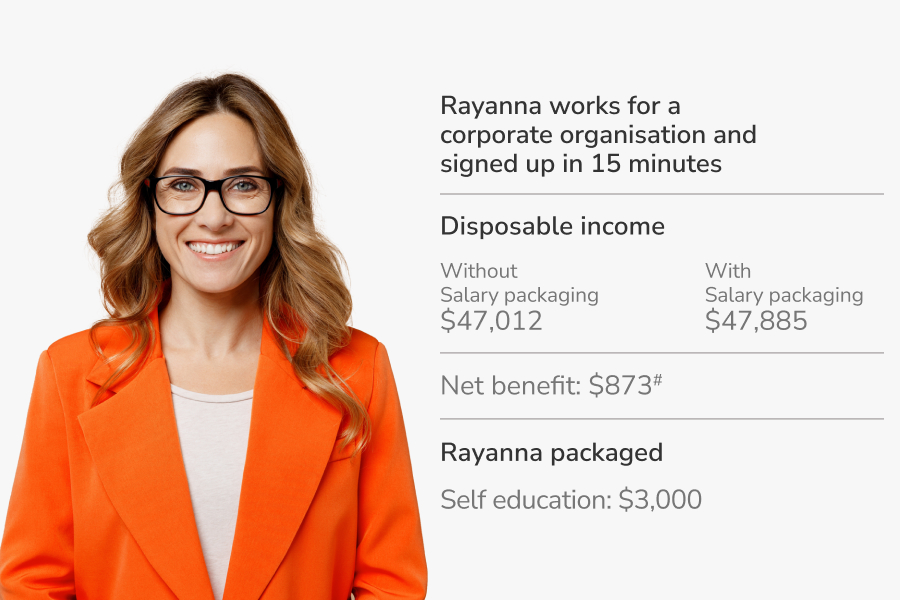

Corporate, mining and other for-profit organisations in QLD can salary package a car through a novated lease, work-related expenses, and many other expenses that don’t attract Fringe Benefits Tax.

#Estimate Only: Not financial advice. Tax outcomes will vary based on individual circumstances.

The great news is not only can you still salary package when you have a HECS-HELP debt but you could take home more money each year and be paying down your debt faster. All you need to do is ask your payroll department to deduct additional HECS-HELP repayments.

Ready to salary package? We set it all up with your employer, so you don’t do much at all.

Salary Sacrifice for QLD Healthcare Employees

Salary Sacrifice for QLD Charity Employees

Salary Sacrifice for QLD Corporate Employees

How might having a HELP/HECS debt impact my salary packaging?

You can benefit from salary packaging even if you have a HELP (Higher Education Loan Program) or HECS (Higher Education Contribution Scheme) debt... learn more

How do I claim?

Three ways to claim your salary packaging benefits... learn more

How do I avoid a shortfall at tax time for unpaid HECS/HELP repayments?

You should let your payroll department know when you start salary packaging as they may need to increase or recommence the amount of your withholding-tax deductions... learn more

Is salary packaging easy to manage?

When it comes to salary packaging, we take care of any hassles, so you can focus on enjoying the benefits. Once we set up your account, we manage it for you... learn more

*Heath: The estimated potential tax benefit is based on the assumption that the disposable income is based on an eligible employee with an annual salary of $60,000 salary packaging to a $9,010 per annum limit and claiming $2,650 in venue hire and meal and entertainment expenses. PAYG tax effective 1 July 2024 have been used. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Your disposable income will vary based on your income and personal circumstances.

^Charlie: The estimated potential tax benefit is based on the assumption that the disposable income is based on an eligible employee with an annual salary of $60,000 salary packaging to a $15,900 per annum limit and claiming $2,650 in venue hire and meal and entertainment expenses. PAYG tax effective 1 July 2024 have been used. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Your disposable income will vary based on your income and personal circumstances.

#Rayanna: The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages the $3,000 per annum. FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded.

Things you need to know: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, and you should consider if they are acceptable before you accept any arrangements with RemServ, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. RemServ may pay and/or receive commissions in connection with its services.